Can I Deduct Medical Expenses?

Medical expenses can quickly add up, and many people wonder whether they can deduct these costs on their taxes. The answer is yes—medical expenses can be deducted, but specific rules and limits exist. At Quantum Tax Strategies, we help individuals and families understand how to take advantage of medical expense deductions and reduce their tax burden. Let’s explore the ins and outs of medical expense deductions and how you can determine if your healthcare costs qualify.What Medical Expenses Are Deductible?

The IRS allows you to deduct qualified medical and dental expenses that exceed a certain percentage of your adjusted gross income (AGI). Qualified expenses include out-of-pocket costs for medical services that are essential to diagnosing, treating, or preventing diseases. Some examples of deductible medical expenses include:- Payments to doctors, surgeons, and specialists

- Hospital services

- Prescription medications

- Medical equipment (e.g., wheelchairs, hearing aids, eyeglasses)

- Mental health services and therapy

- Dental treatments, including orthodontics

- Long-term care and nursing services

- Health insurance premiums (if not paid pre-tax by an employer)

What Are the Limitations?

For the 2024 tax year, you can deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI). If your AGI is $50,000, you can only deduct medical expenses exceeding $3,750. For example, if you incurred $5,000 in qualified medical expenses, you could deduct $1,250 ($5,000 – $3,750).How to Calculate Your Deductible Medical Expenses

To calculate your deductible medical expenses, you’ll first need to determine your total qualified medical costs for the year. Then, subtract 7.5% of your AGI from this total. The remaining amount can be deducted from your taxable income if you choose to itemize deductions on your tax return. Here’s a simple example:- Adjusted Gross Income (AGI): $70,000

- Total Medical Expenses: $8,000

- 7.5% of AGI: $5,250

- Deductible Amount: $8,000 – $5,250 = $2,750

Should You Itemize or Take the Standard Deduction?

To claim medical expense deductions, you’ll need to itemize your deductions on your tax return instead of taking the standard deduction. For 2024, the standard deduction is $14,600 for single filers and $29,200 for married couples filing jointly. If your total itemized deductions—including medical expenses—don’t exceed the standard deduction, itemizing may not make sense. However, if your qualified expenses are high, itemizing can result in significant tax savings.What’s Not Deductible?

While many healthcare costs are deductible, some expenses are not. Here are a few examples of what cannot be deducted:- Cosmetic surgery (unless necessary for a medical condition)

- Over-the-counter medications

- Vitamins or other supplements

- General health purchases, like gym memberships

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

Another way to save on medical costs is through Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). Contributions to these accounts are tax-deductible, and the funds can be used to pay for qualified medical expenses. By contributing pre-tax dollars to an HSA or FSA, you can lower your taxable income while covering your healthcare costs.Final Thoughts

Medical expenses can be deducted, but you must meet the IRS’s requirements to claim them. Whether or not it’s beneficial to deduct medical expenses depends on your total expenses, your AGI, and whether itemizing your deductions results in greater savings than taking the standard deduction. At Quantum Tax Strategies, we are committed to helping you navigate these tax rules and ensure you’re getting the most from your deductions. Contact us today to learn more about how we can help you with medical expense deductions and all your tax planning needs! Let’s optimize your tax strategy together—schedule a consultation with Quantum Tax Strategies today!Ready to take control of your tax strategy?

Contact Quantum Tax Strategies today to schedule a consultation and start saving!

Call Us Today! (877) 205-2565 | Email: [email protected]

related news & insights.

Home Sale: Failure to Plan may Raise Your Tax Bill

Which is Better: A Tax Credit or a Tax Deduction

Business Succession and Estate Planning Should Be Inseparable

What is the Difference Between Marginal and Effective Tax Rates

Discover the Business Credits and Tax Benefits You Might Be Missing

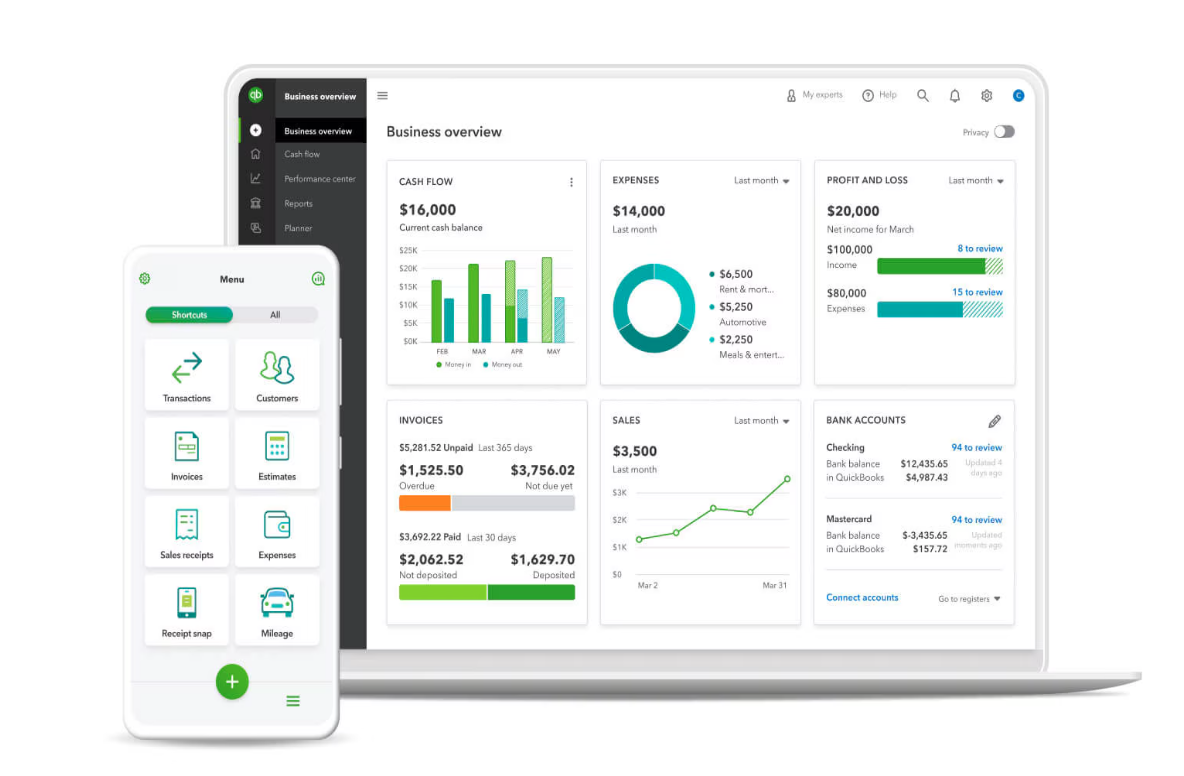

How to Identify Who Owes You in QuickBooks Online

Why Employers Should Offer Educational Assistance Programs